Case Specific Stories

Saved on monthly mortgage payments $953.41

-

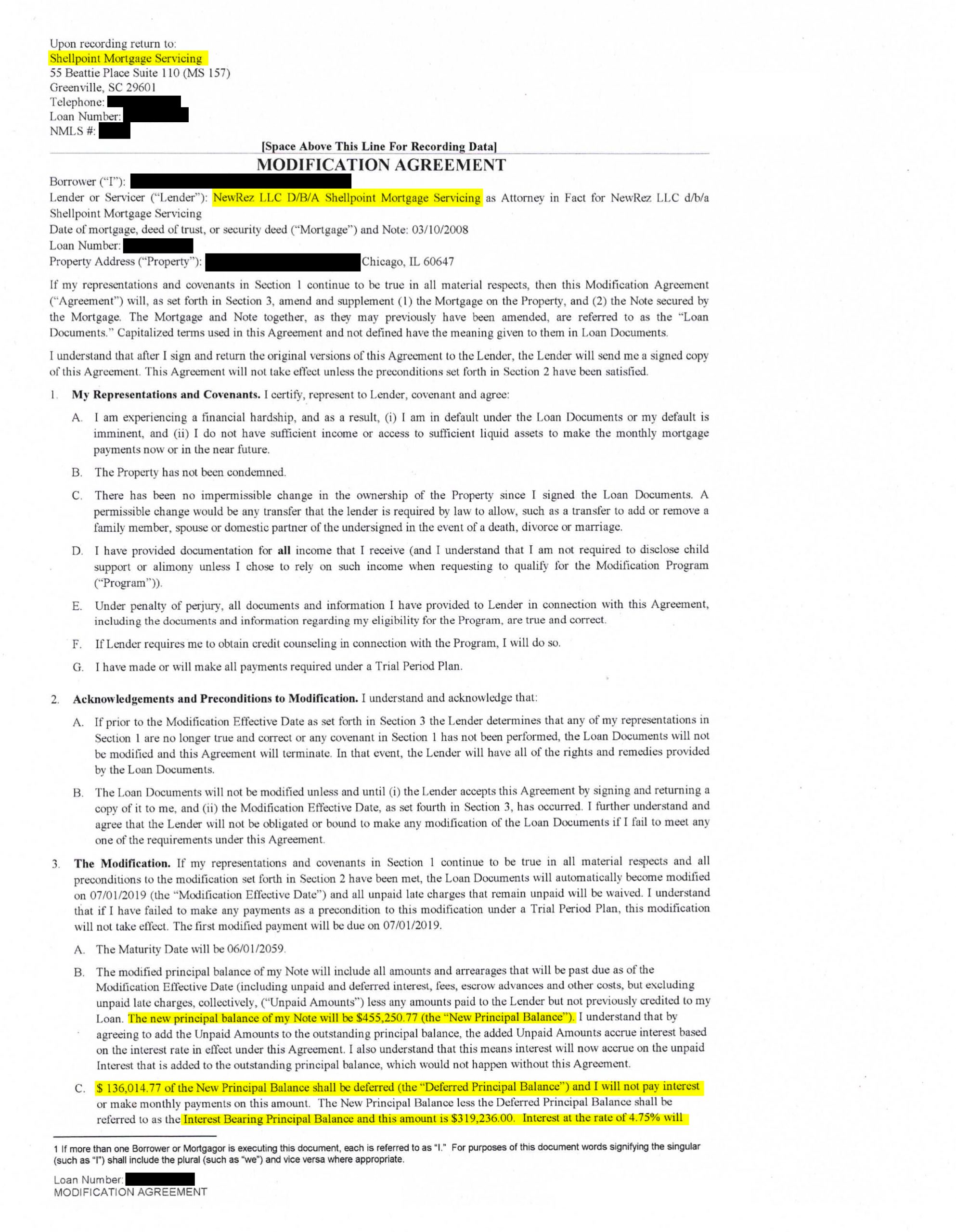

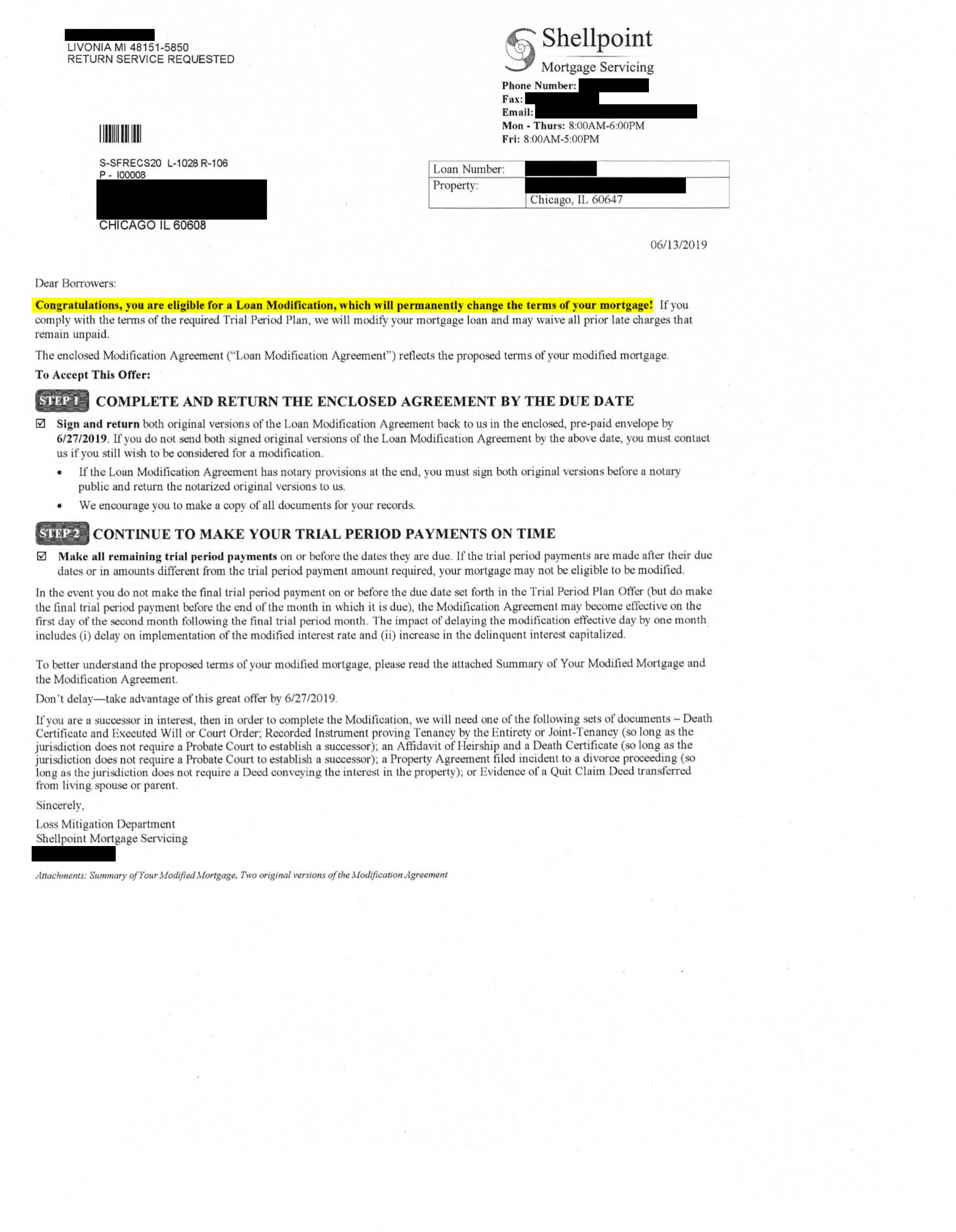

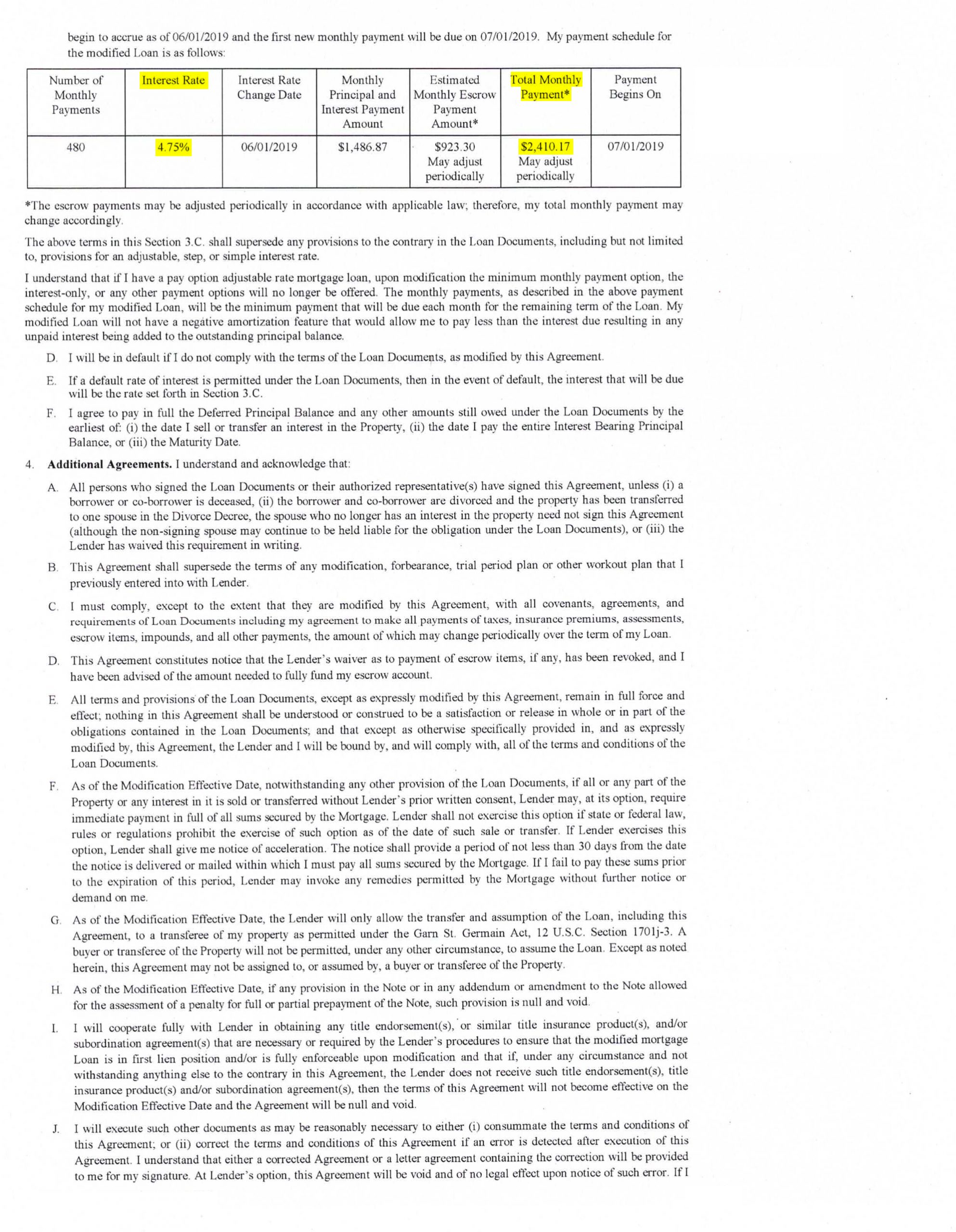

Approved Modification

Lender: NewRez-Shellpoint Mortgage Servicing -

Home Retention Approved

Approved Modification Agreement -

This couple saved $953.41 a month! Qualifying for a modification changed their entire financial picture. Instead of paying on $455,250.77 at 7.5% The new rate is 4.75% on $319,236.00 Paying 0% on the remaining $136,014.77

Interest Rate: 7.5% to 4.75% Mortgage Payment: $3,363.58 to $2,410.17 Monthly Savings: $953.41

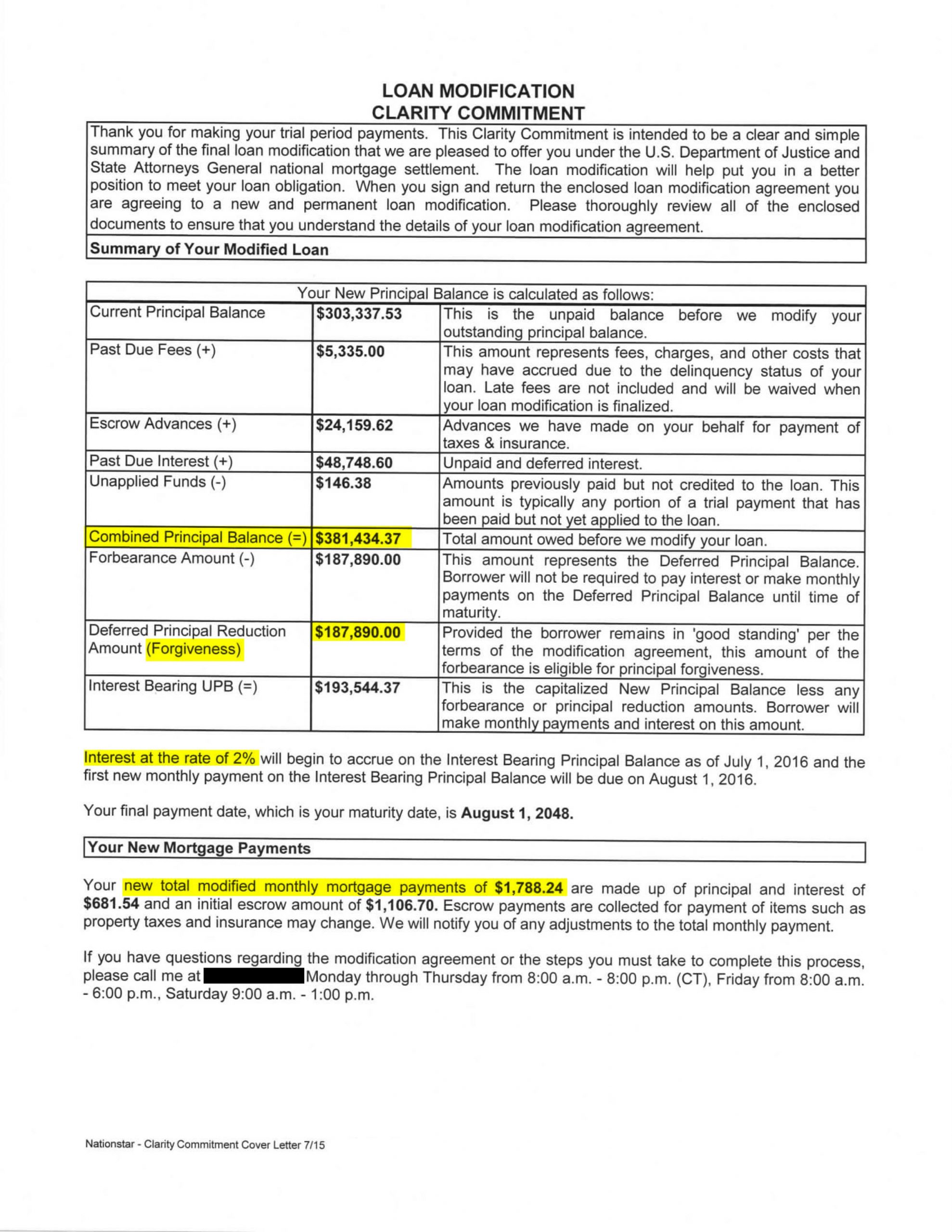

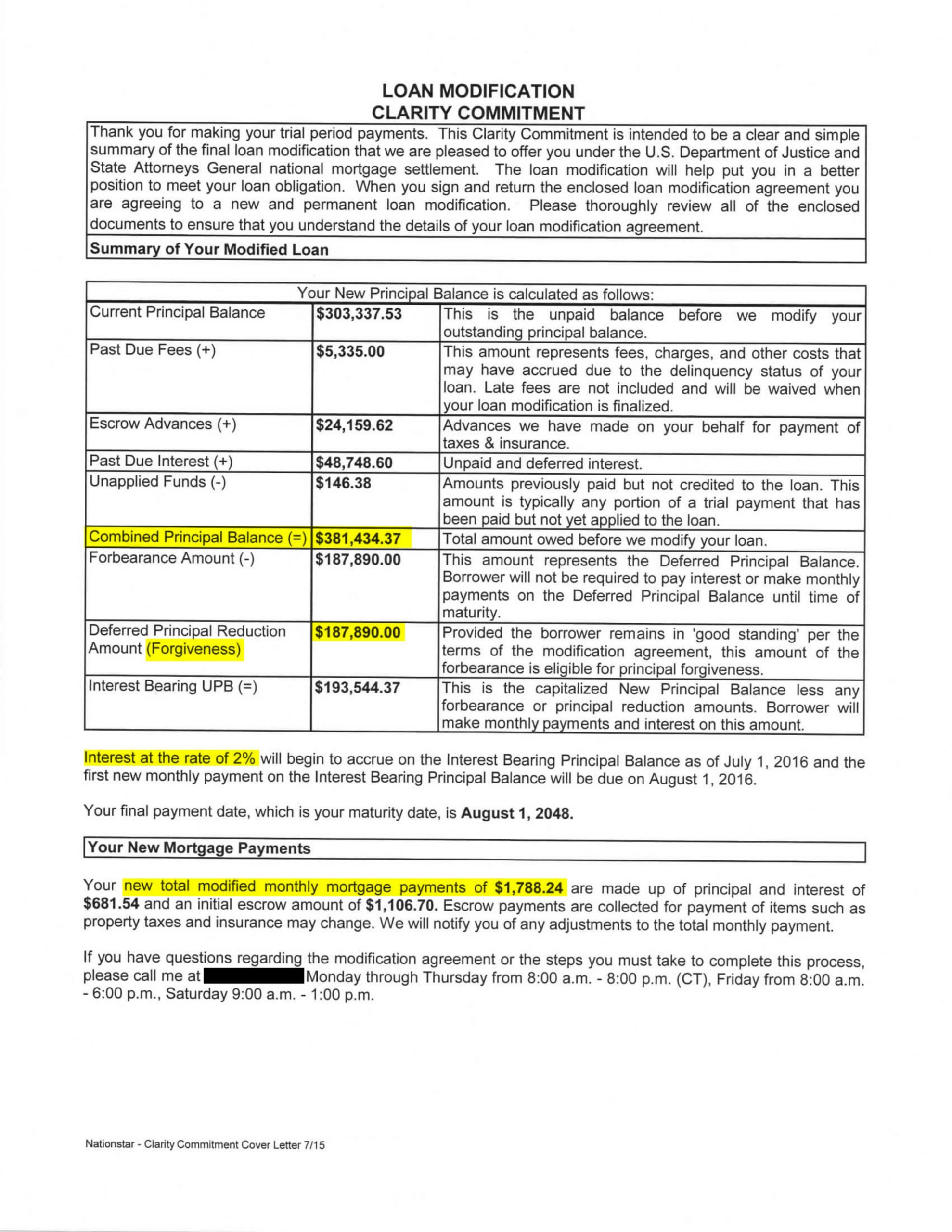

$187,890.00 of mortgage debt gone forever! True Mortgage Forgiveness

-

Approved Modification

Lender: Nationstar Mortgage -

Home Retention Approved

Making Home Affordable Program -

Behind in payments by over $75,000 and worried they could never qualify for a modification, panic set in. From 4% with a previous modification that they couldn’t pay on, the rate was lowered to 2% and $187,890 is never due!

Interest Rate: 4% to 2% This is the 2nd modification owners received Credit was repaired, and they have equity.

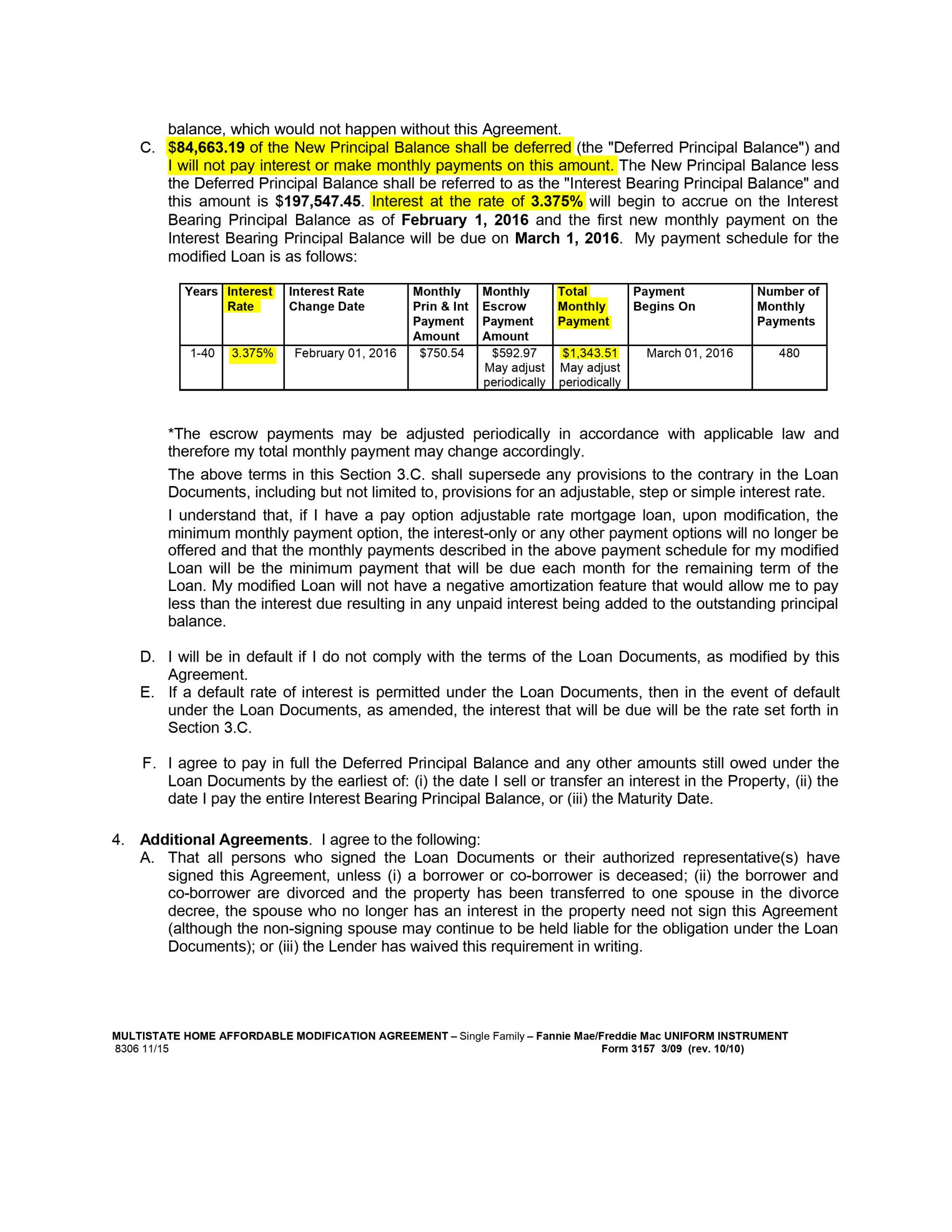

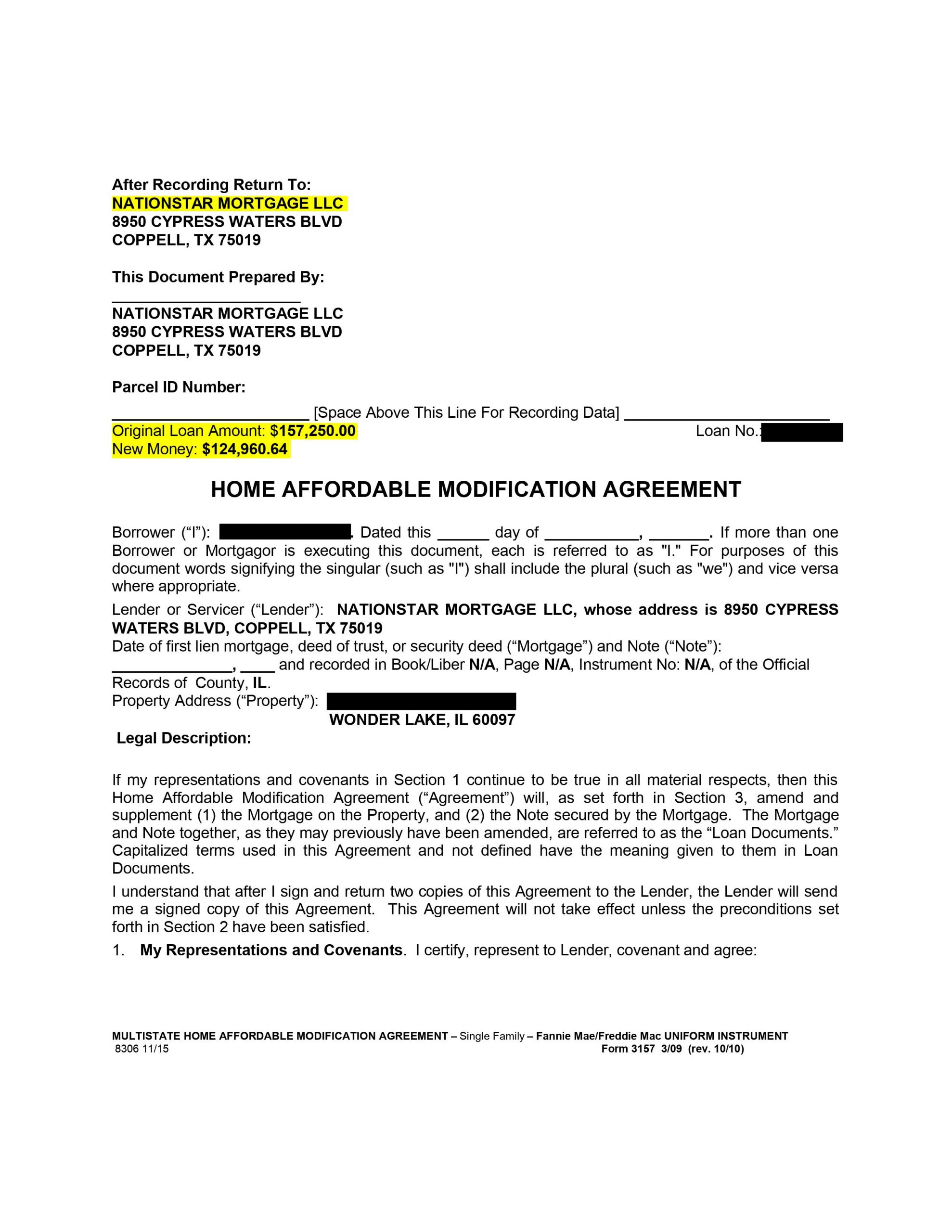

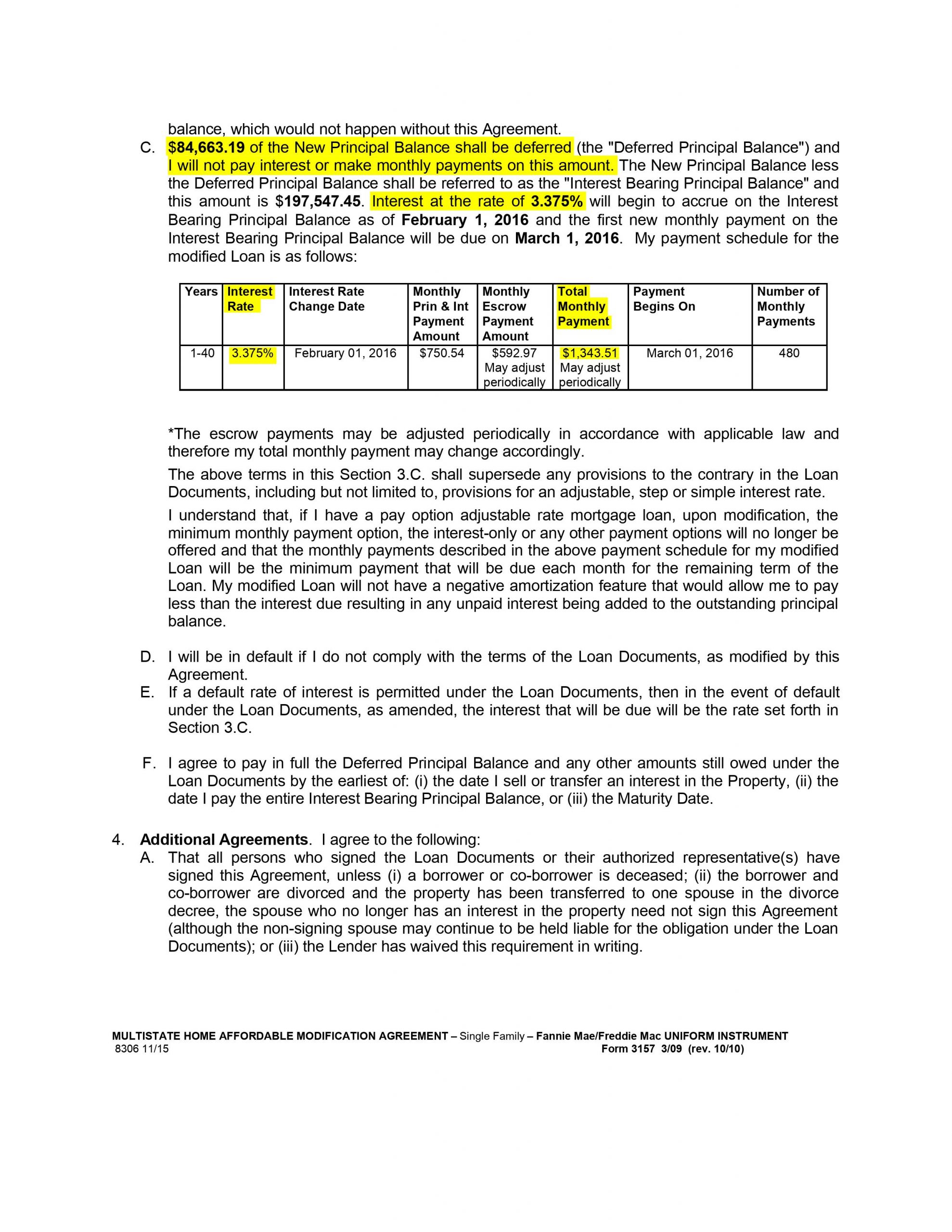

Lowering our mortgage payments by $451.87 changed everything

-

Approved Modification

Lender: Nationstar Mortgage LLC -

Home Retention Approved

Freddie Mac Workout Program -

The amount this owner needed to make mortgage payments on was lowered by $84,663.19 allowing him to lower his mortgage payments, decrease the interest for the life of the loan and buy the time needed to get back on track with his finances.

Interest Rate lowered: 5.125% to 3.75% Mortgage Payments lowered: $451.87 Deferred Principal: $84,663.19

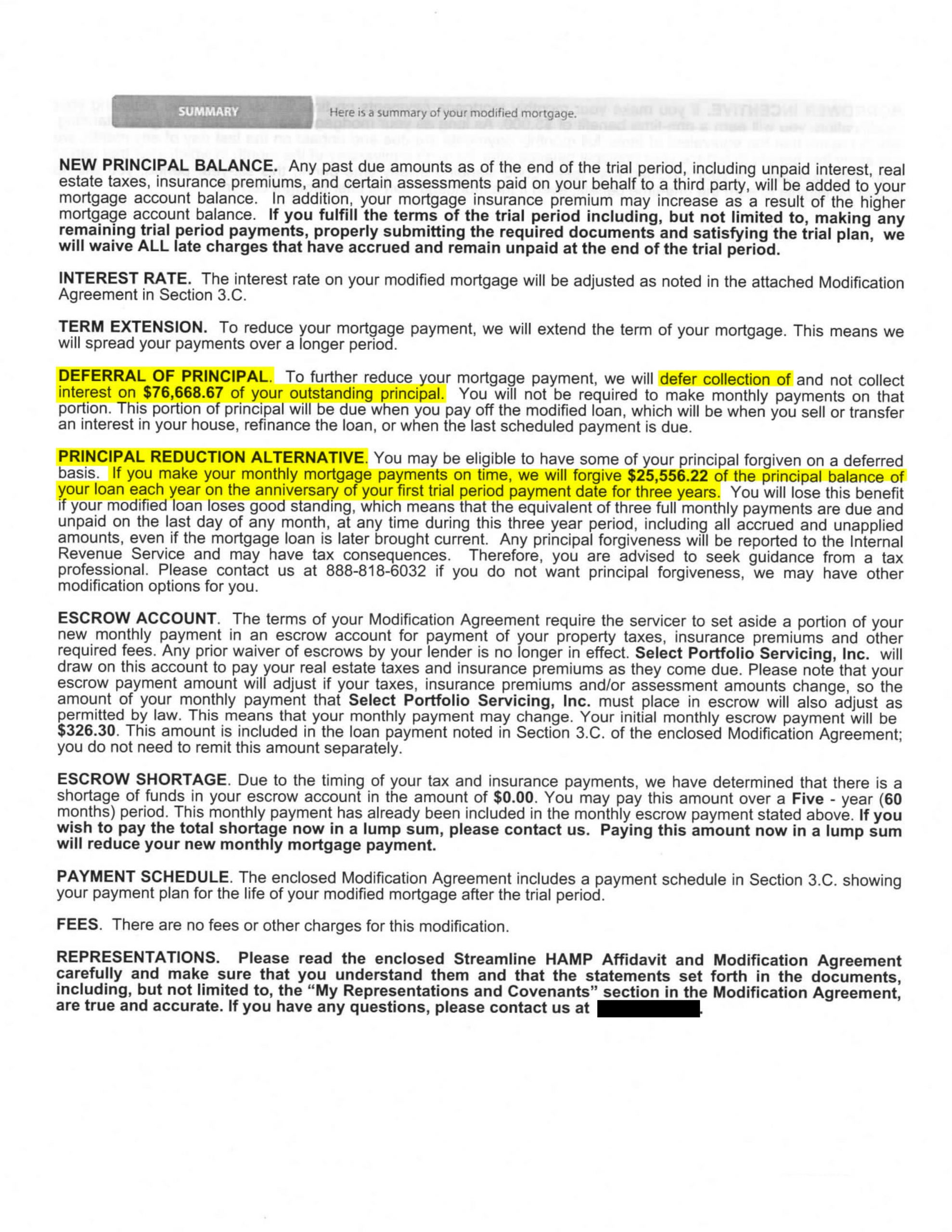

Mortgage Principal Reduction of $76,668.87

-

Approved Modification

Lender: SPS -

Home Retention Approved

Single Family Multistate HAMP -

This police officer couldn’t believe her luck. As long as she makes her payments on time for three years, she will wipe out $76,668.87 of mortgage debt. She couldn’t afford her payments, was ready to walk away and the new modification saved her home.

Interest Rate: 5.75% to 3.5% Mortgage Payment: Lowered by $269.96 Allowing us to save her home and credit

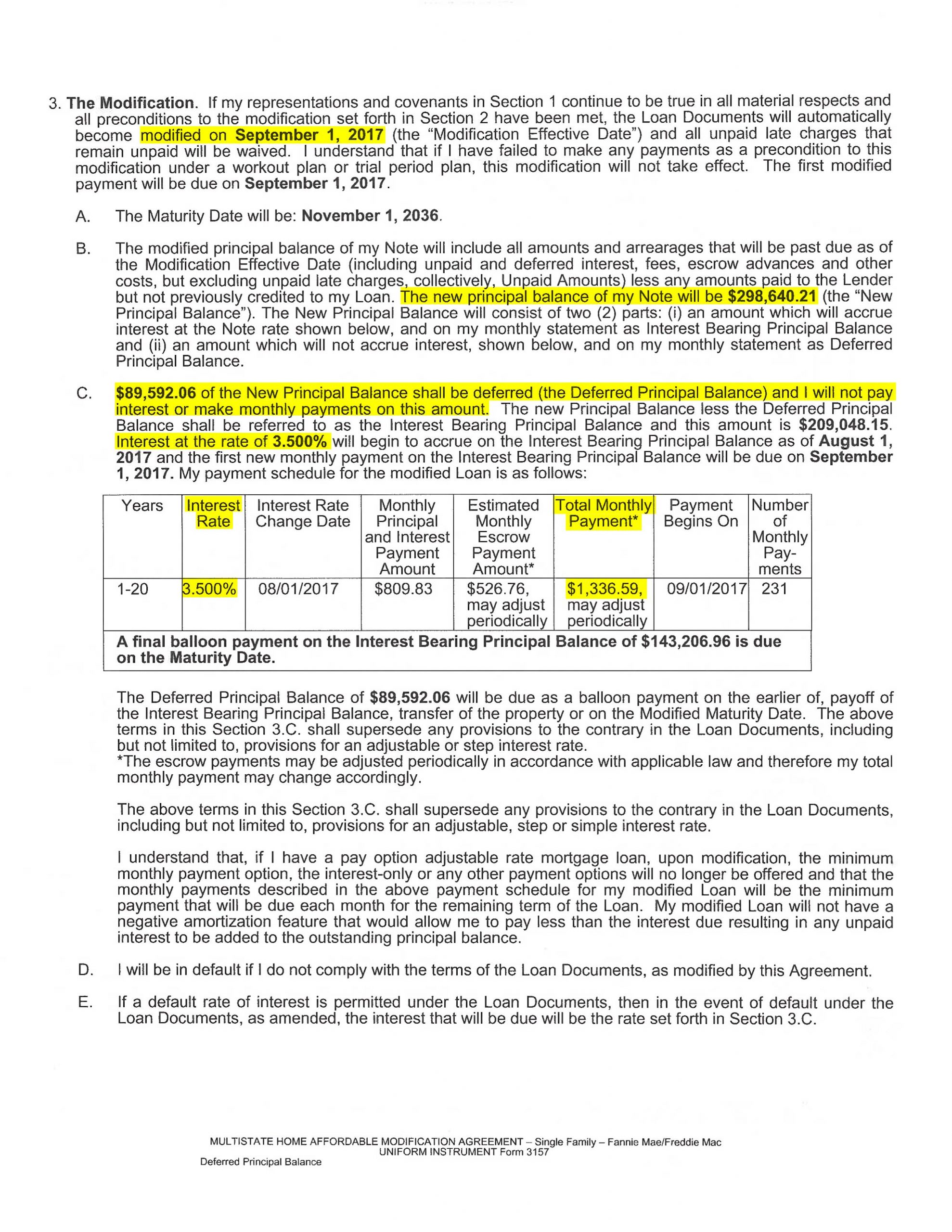

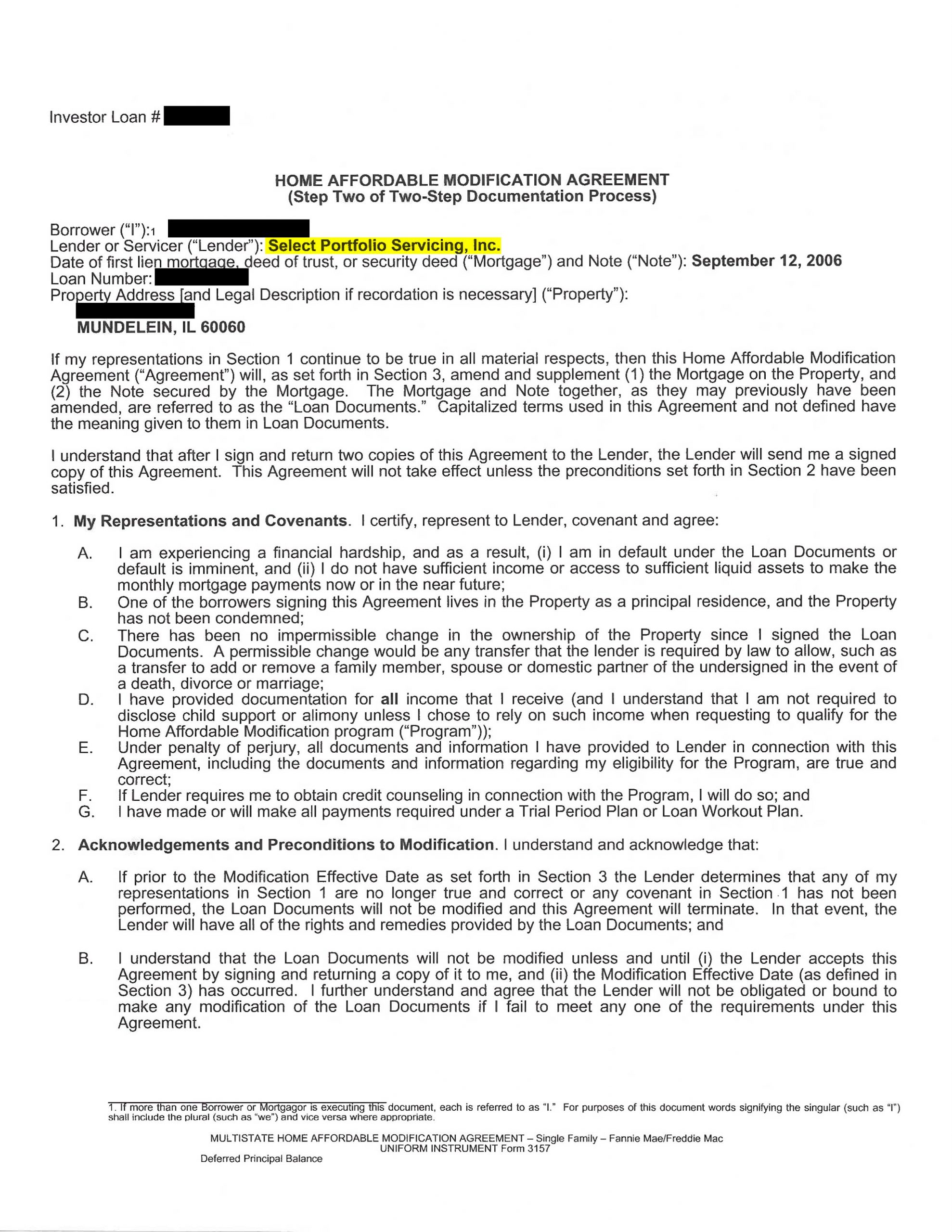

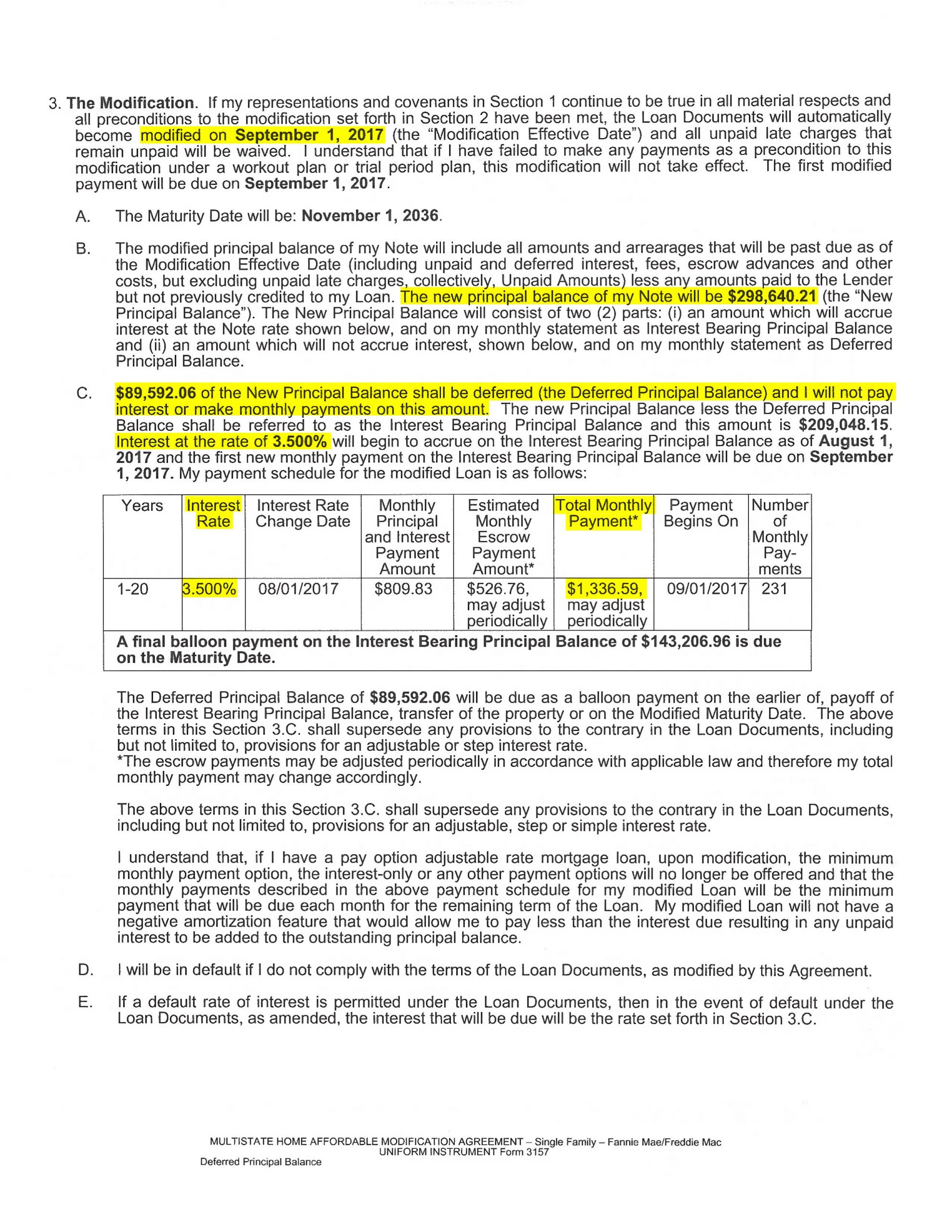

Went from a 15-year mortgage to a 20 year and lowered our rate and payments

-

Approved Modification

Lender: Select Portfolio Servicing -

Home Retention Approved

Freddie Mac Modification -

After two denied modifications on her own, the single mom was able to stay in her home by only paying on $209,048.15 instead of $298,640.21 that was due at the time of modification.

Interest Rate: 6.125% to 3.5% Mortgage Payment: Lowered by $395.34

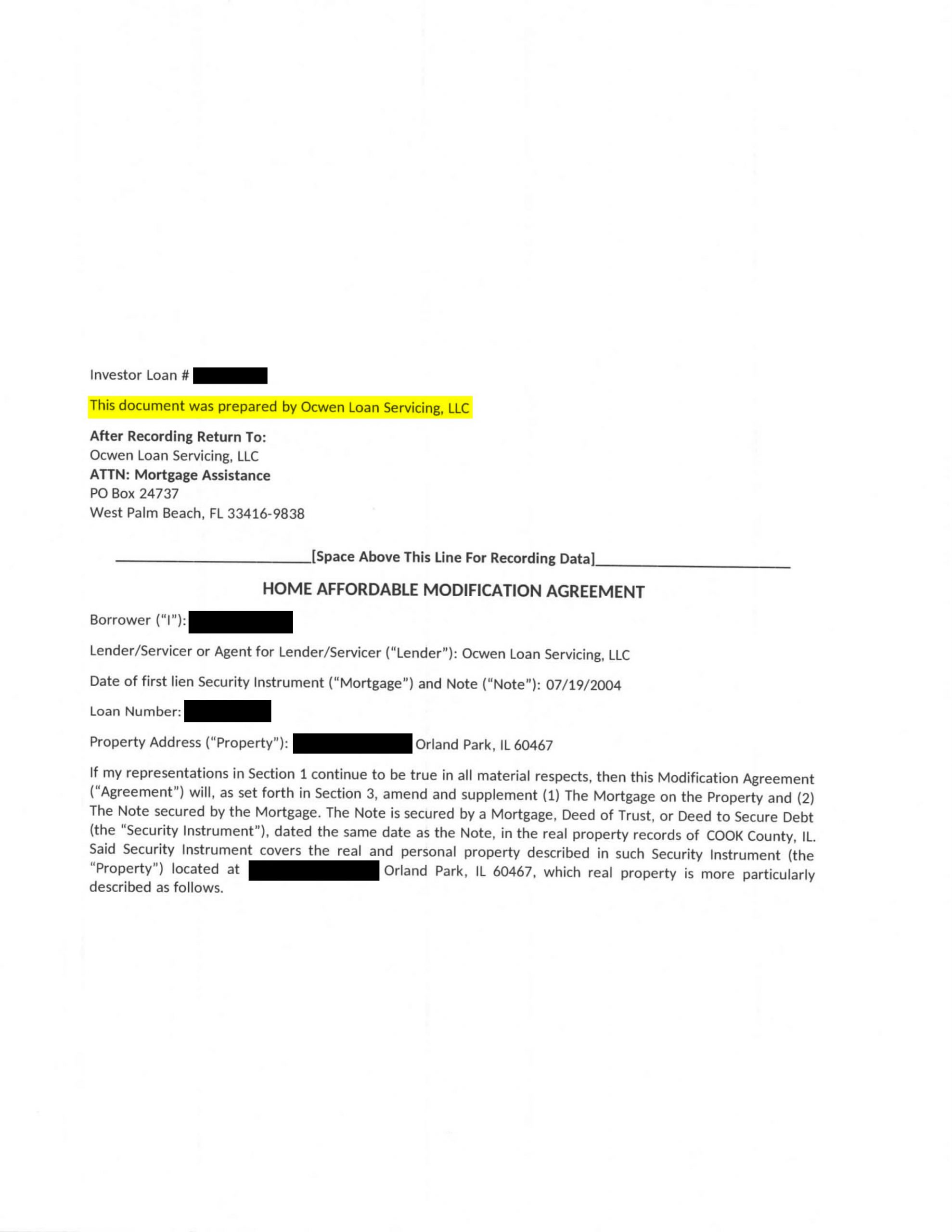

We started underwater by over $100,000 and now have instant equity

-

Approved Modification

Lender: Ocwen Loan Servicing -

Home Retention Approved

Home Affordable Modification HAMP -

After three years of payments $154,201.48 is truly GONE – Forgiven forever! These grandparents only had to make 2% payments on roughly half of what they owed on the mortgage. This lowered their payments by $792.69 AND they have equity in their home again.

Interest Rate: 5.5% to 2% Mortgage Payment: Lowered by $792.69 $154,201.48 permanent principal reduction

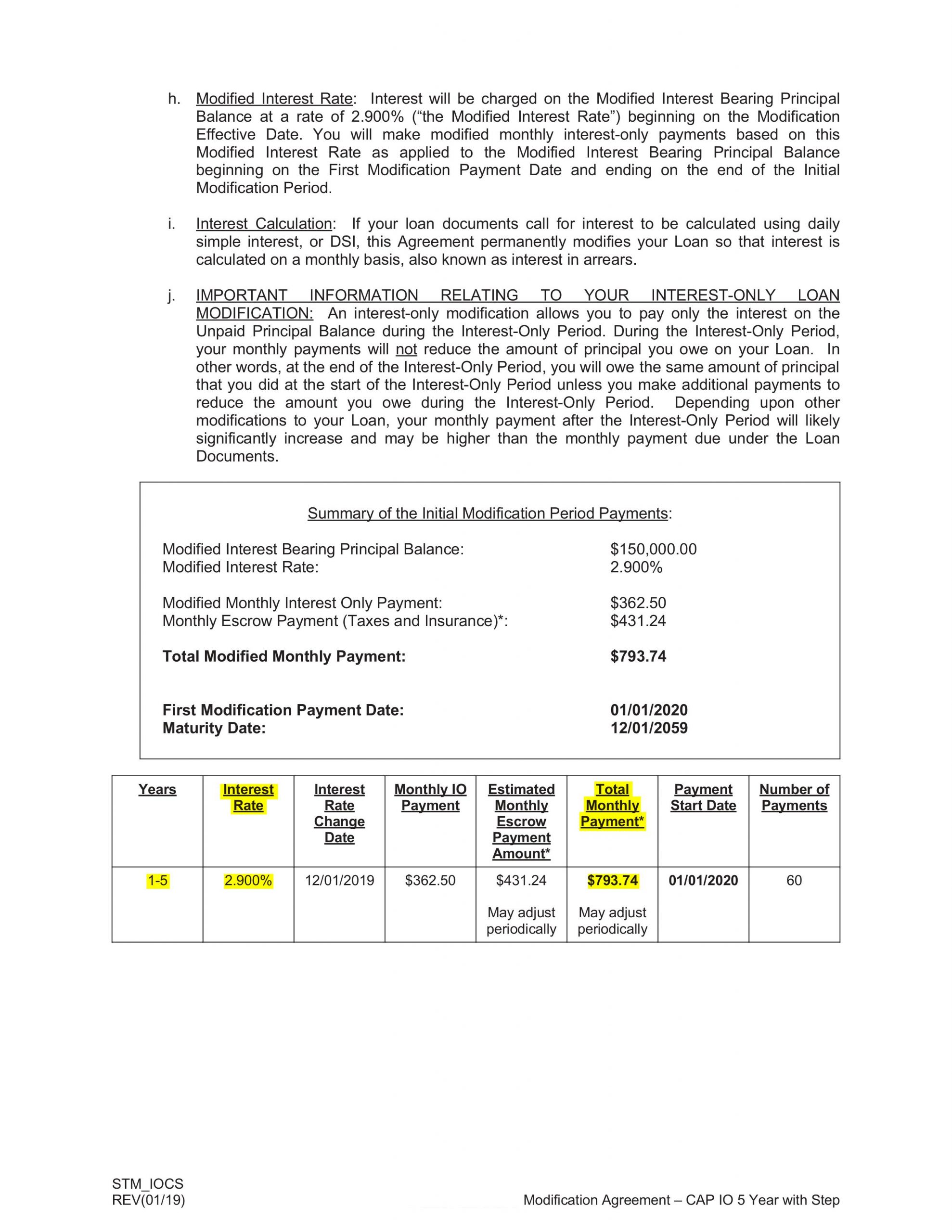

A 5-year interest only modification allowed us to recoup financially

-

Approved Modification

Lender: Caliber Home Loans -

Home Retention Approved

5 year I/O, Deferment & Forgiveness -

This modification changed this families lives. $100,559.12 true principal forgiven! Brining their balance down to $150,000. The first five years of the modification the remaining balance did not accrue any interest.

$100,000 in mortgage debt erased

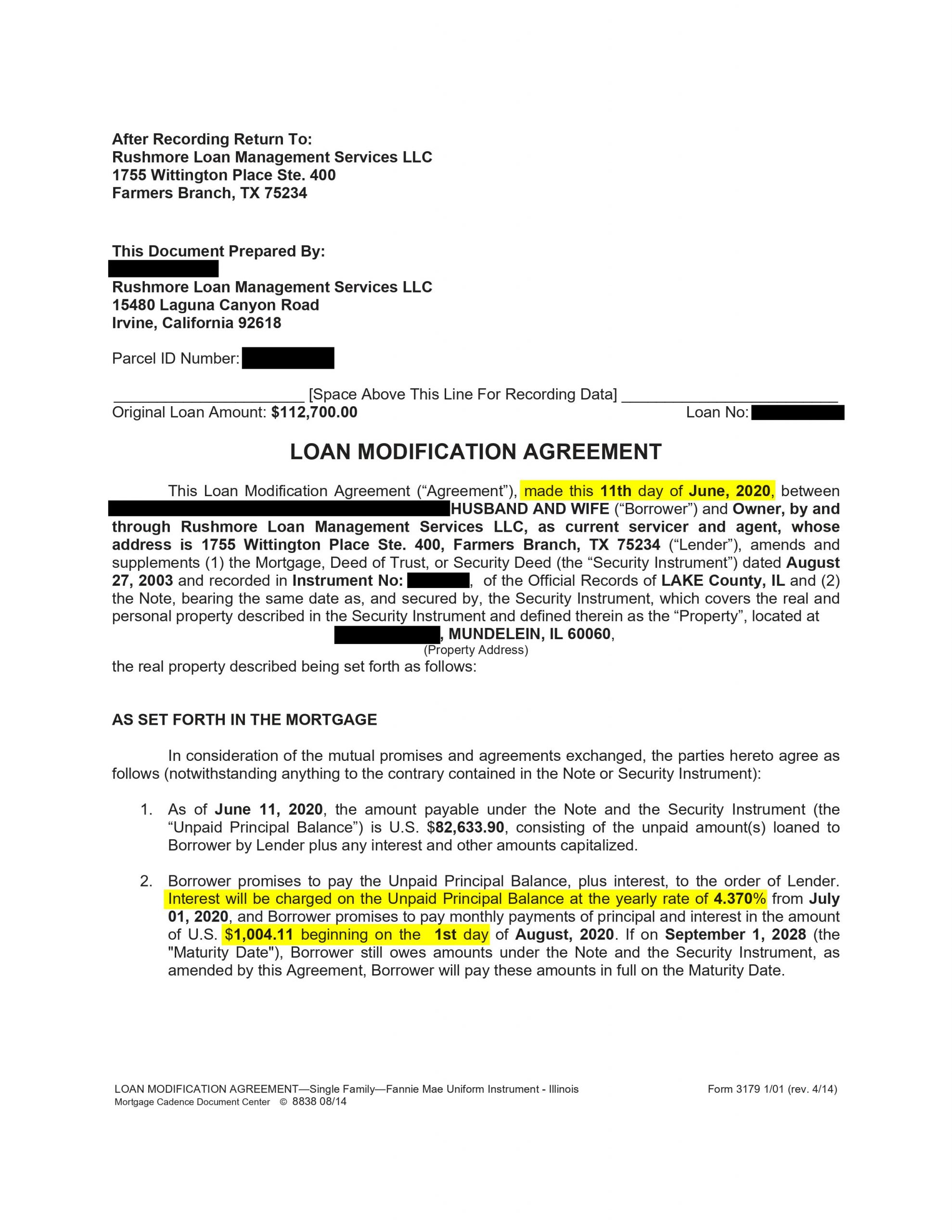

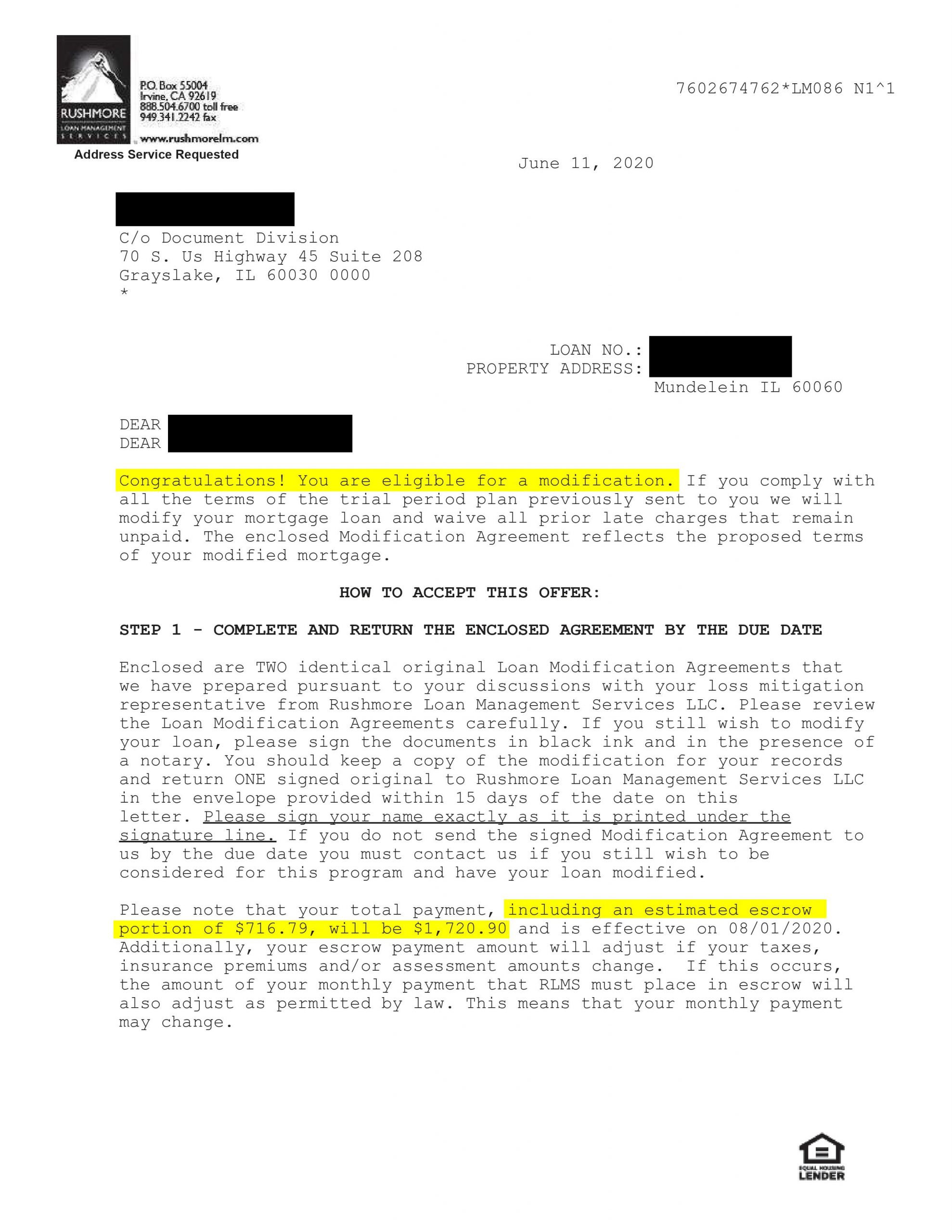

Our rate was reduced from 8.25% to 4.37%

-

Approved Modification

Lender: Rushmore Loan Services -

Home Retention Approved

Fannie Mae Modification -

This owner was paying principal and interest of $1,594.76 monthly. They were approved for a payment reduction to $1,004.11 saving $590.65 monthly even during the Pandemic shut down

Interest Rate: Reduced by almost 4%

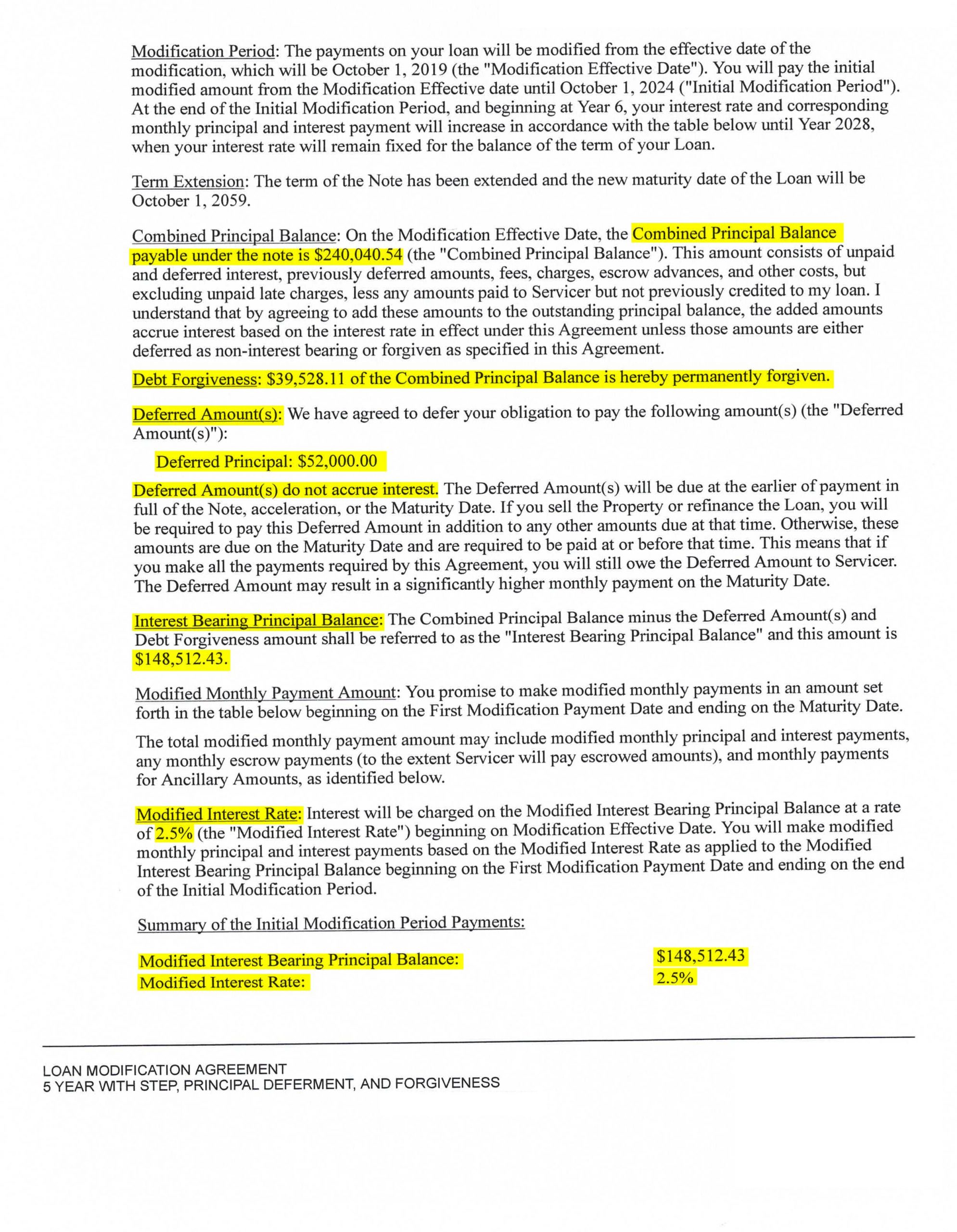

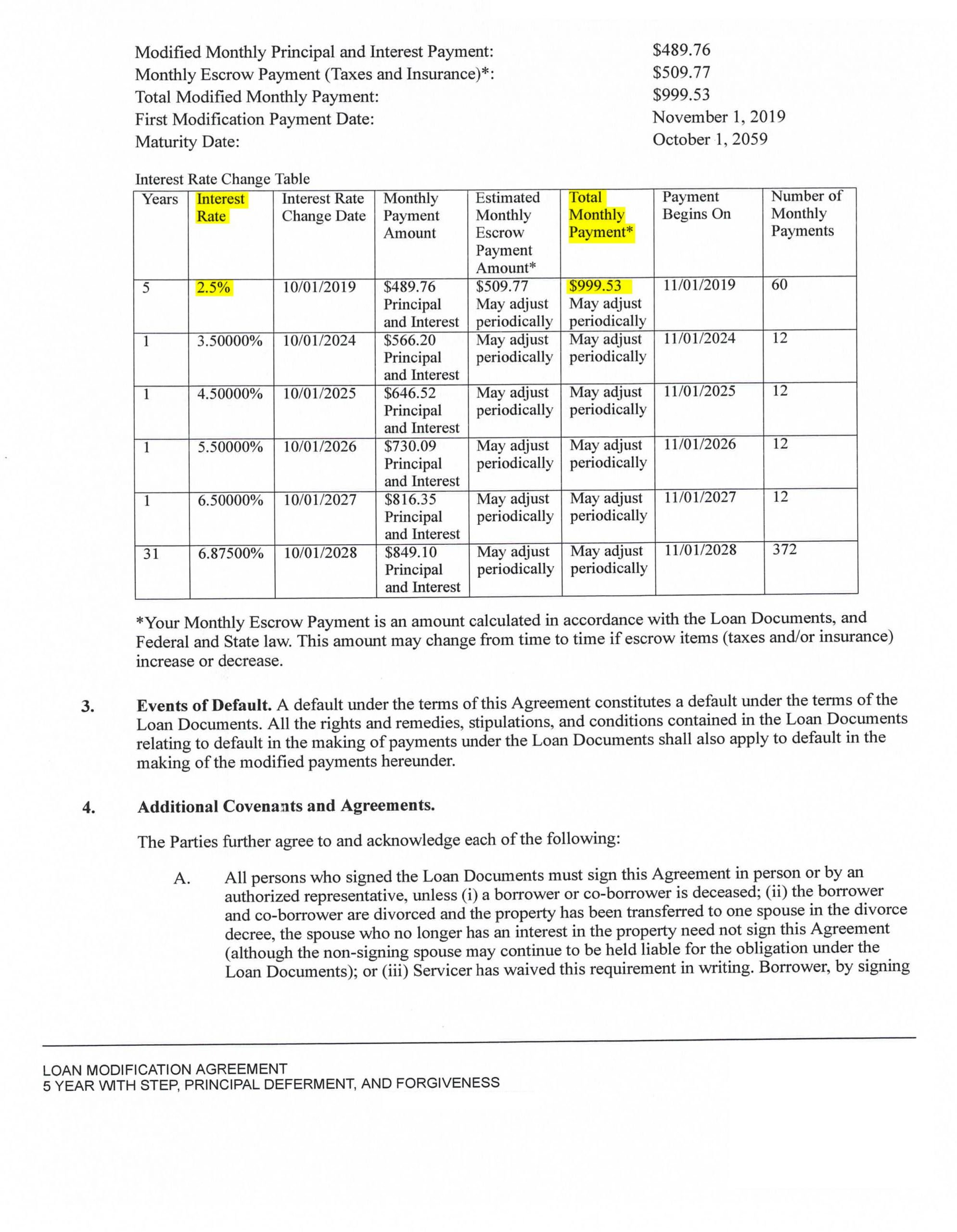

$39,528.11 Mortgage Debt Forgiven

-

Approved Modification

Lender: Caliber Home Loans -

Home Retention Approved

5 year step, Principal Deferment & Forgiveness -

The balance due on this owner’s mortgage was $240,040.54 before receiving a modification. The new mortgage balance dropped to $148,512.43 at 2.5% interest

Interest Rate was 5.25% reduced to 2.5% Mortgage Payment $1,653.22 reduced to $999.53 $52,000 Deferred to end with 0% interest due

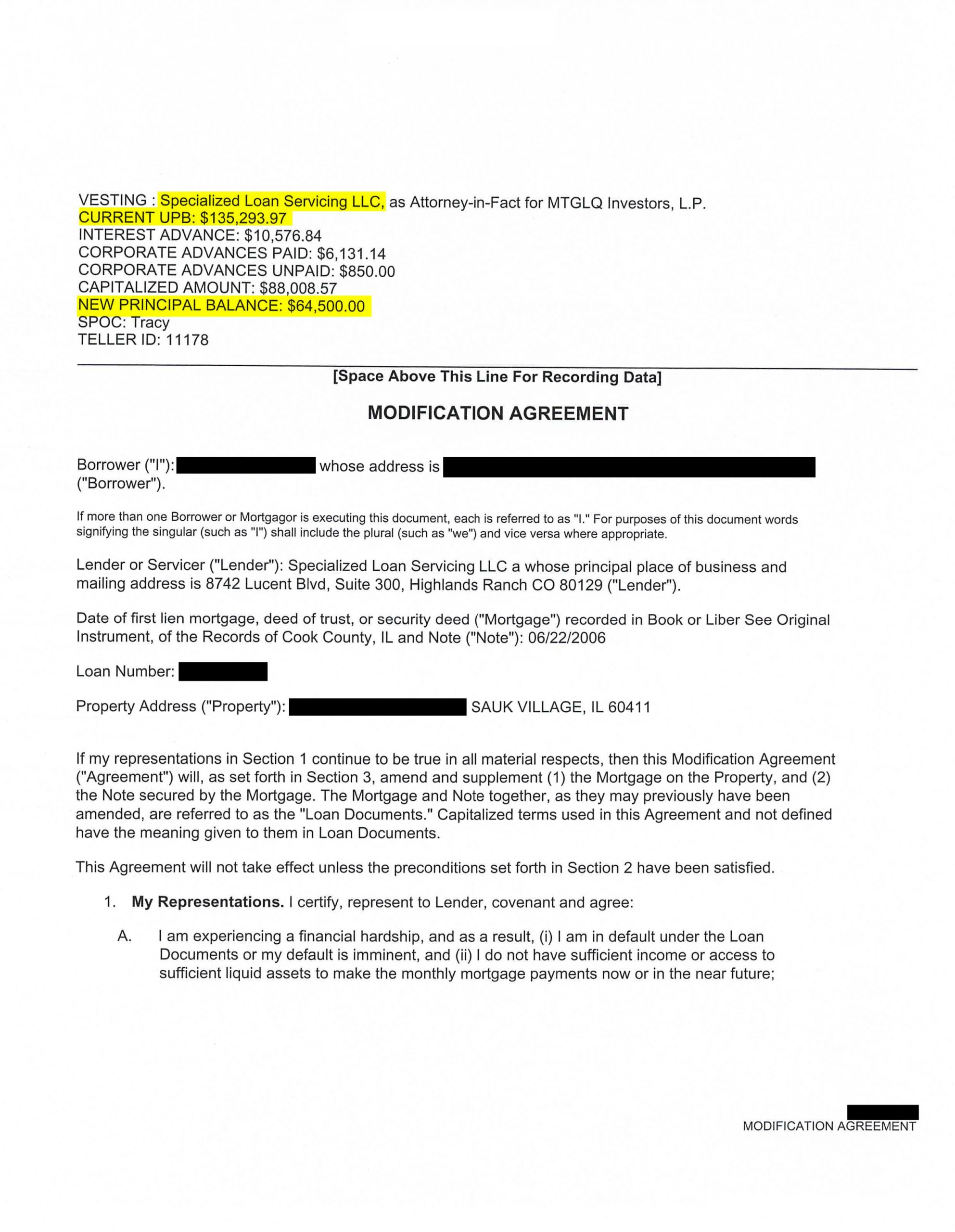

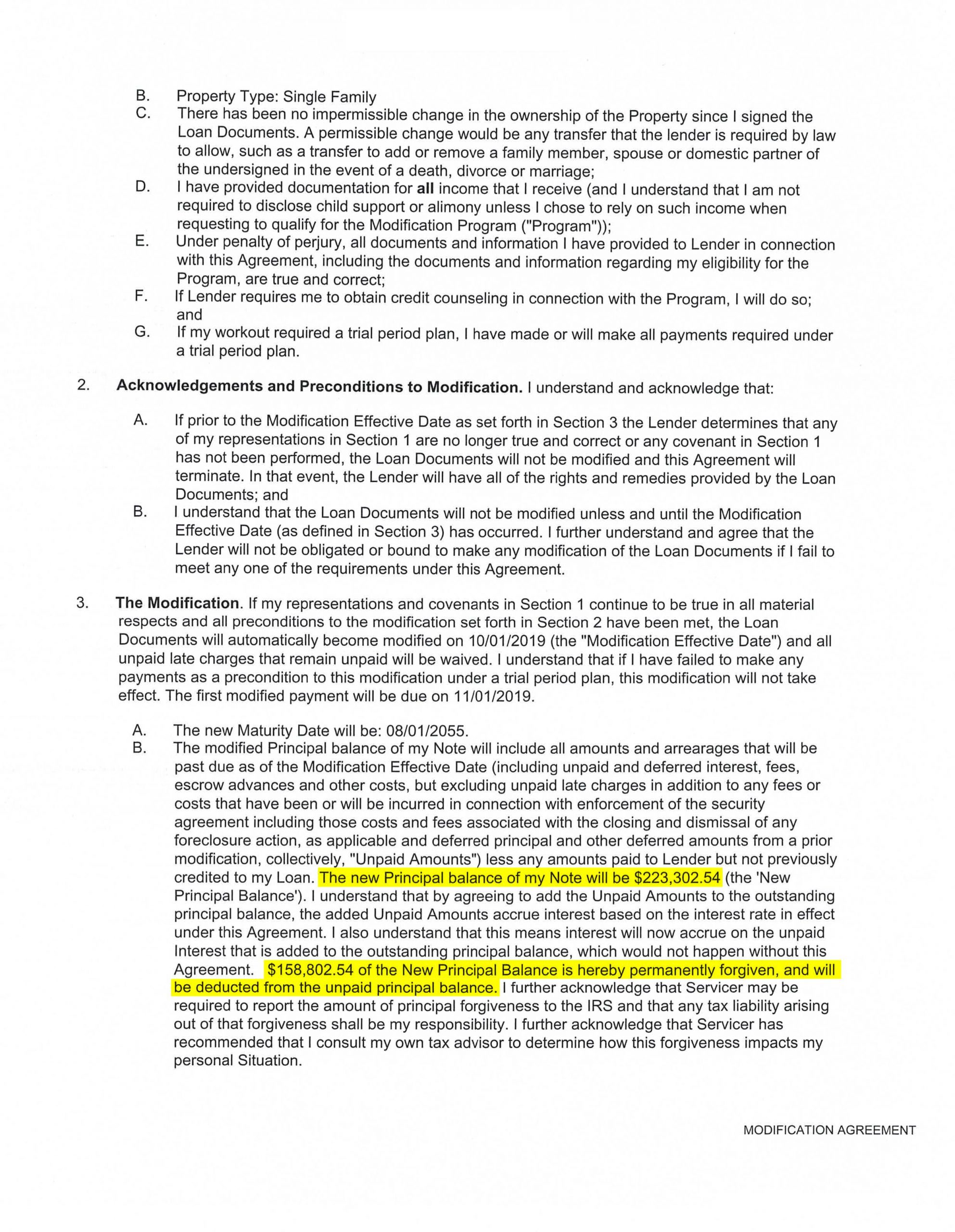

$158,802.54 Principal Forgiveness reducing mortgage payments by $602.58

-

Approved Modification

Lender: Specialized Loan Servicing -

Home Retention Approved

Inhouse Modification Agreement -

2019 and this couple received a true reduction / forgiveness of the mortgage amount they owed. Bringing monthly payments down by $602.58 and making them manageable. Gaining over $150,000 in equity overnight.

$158,802.54 Mortgage Forgiven

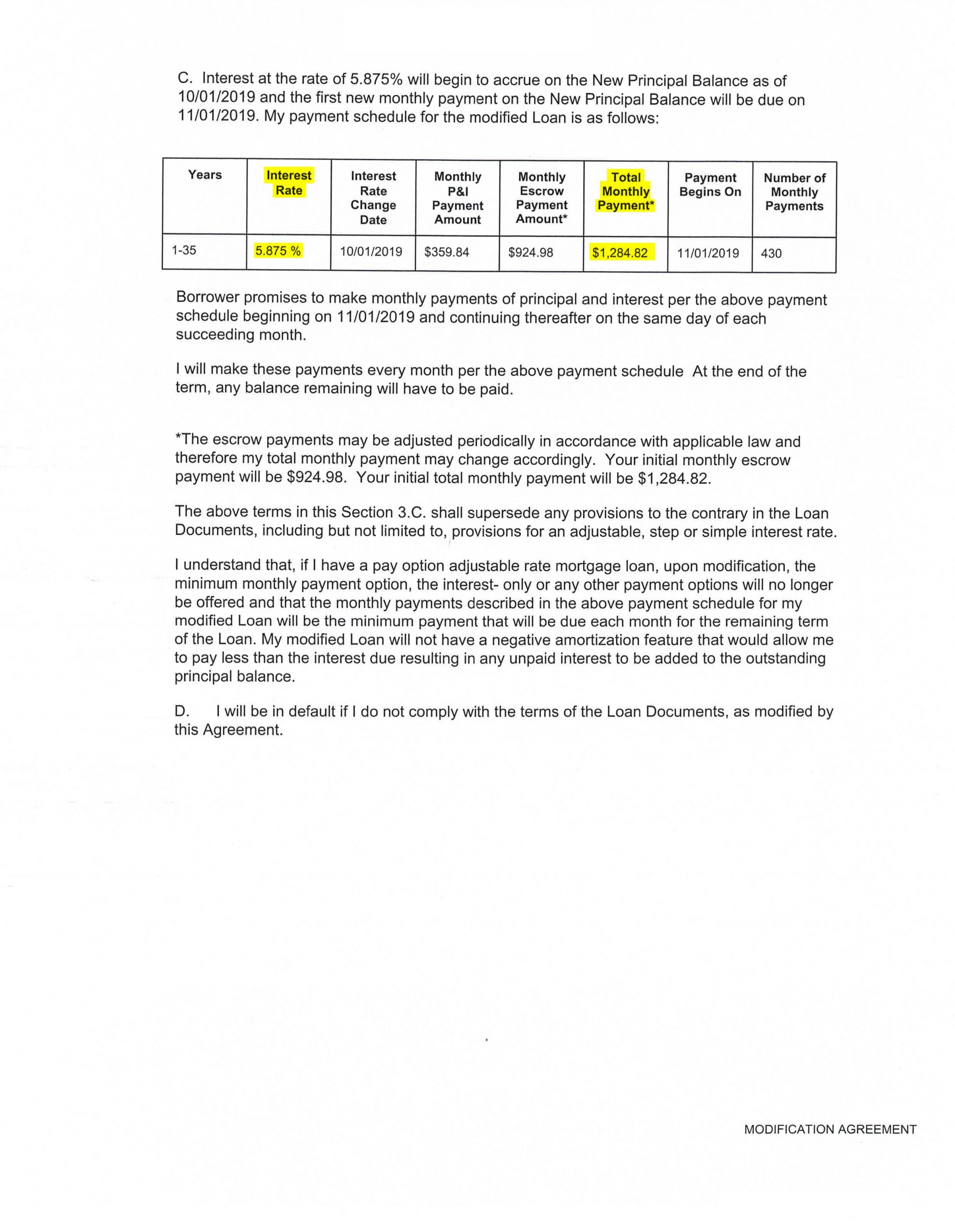

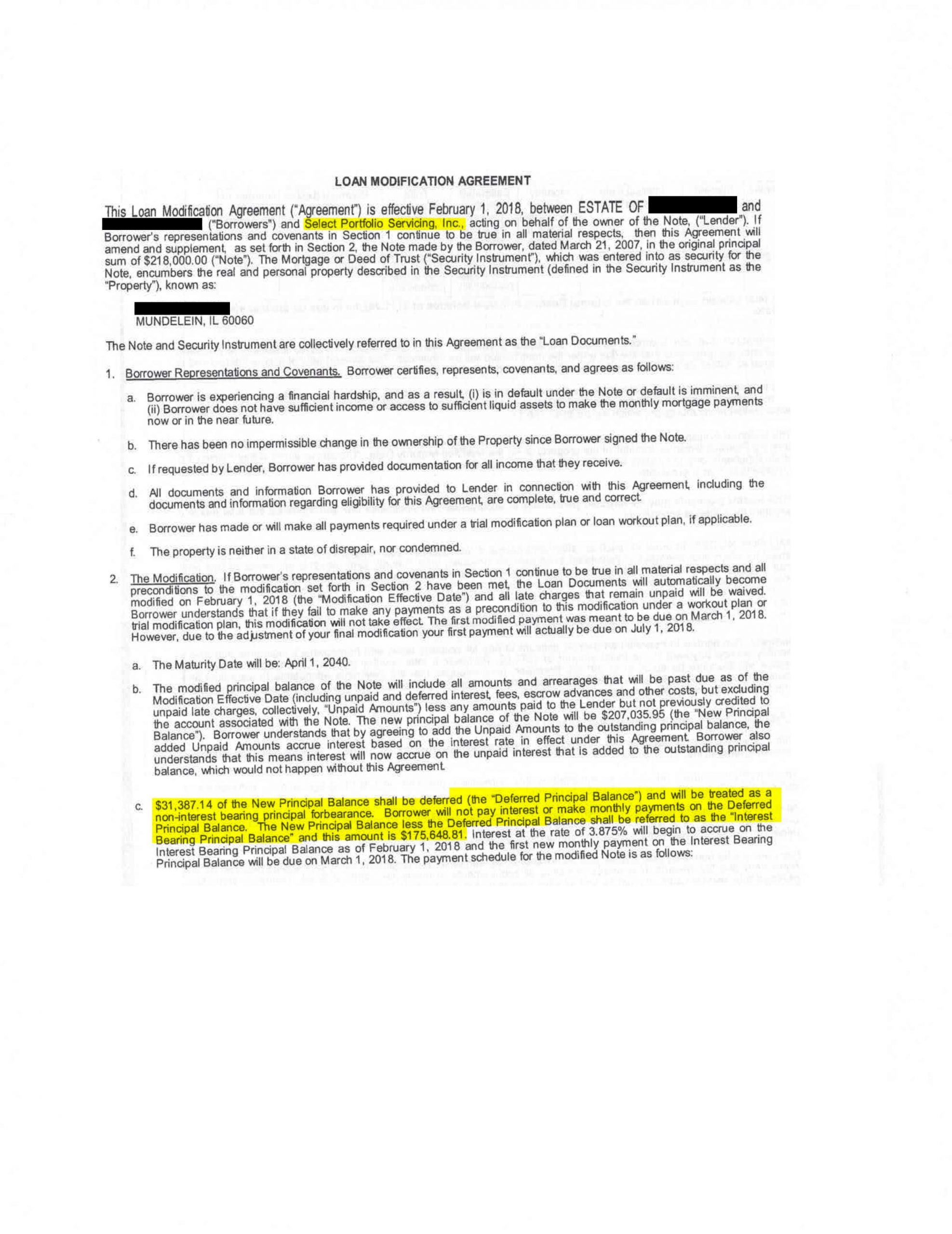

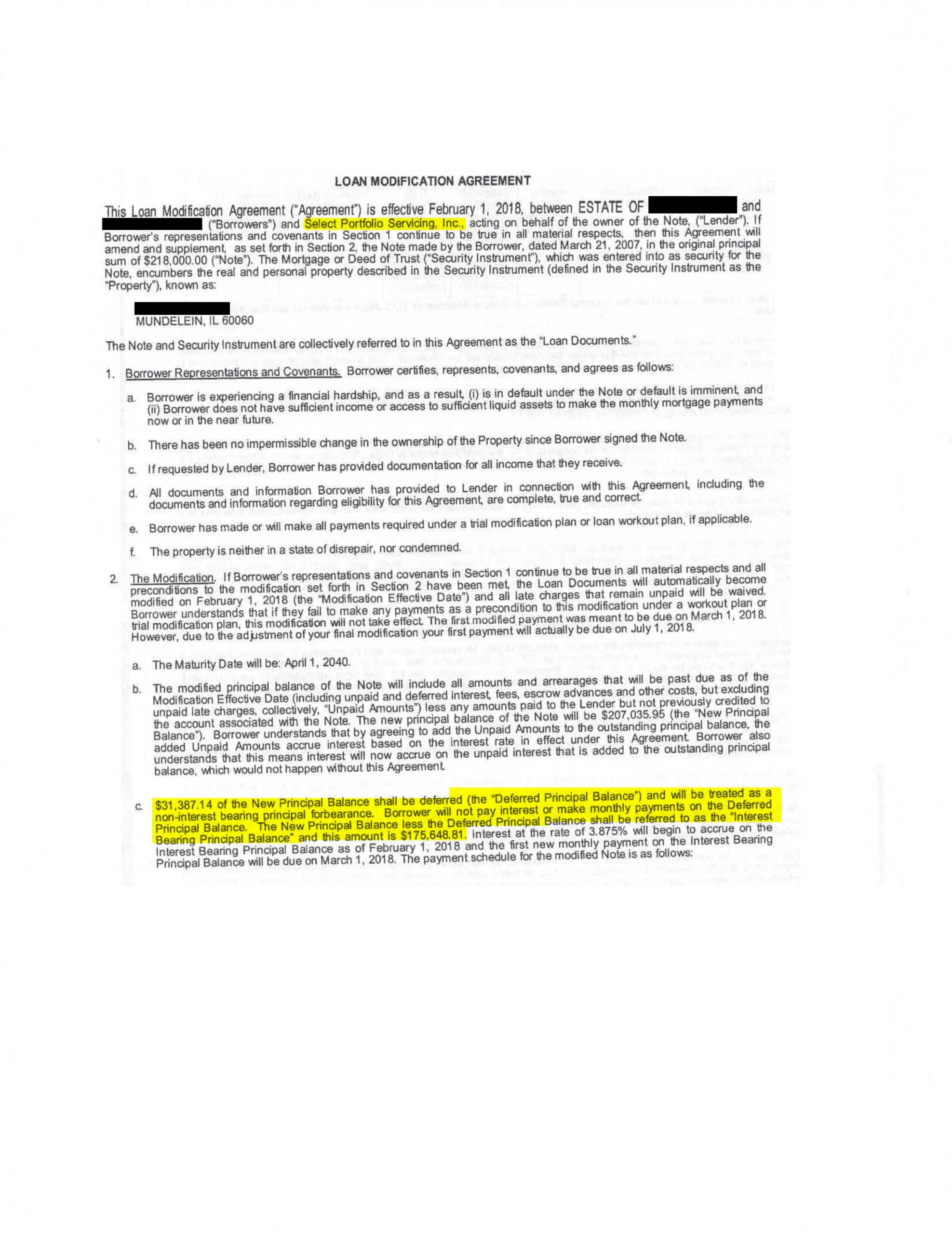

Interest bearing mortgage total reduced by $31,387.14

-

Approved Modification

Lender: SPS Select Portfolio Servicing -

Home Retention Approved

Investor Mortgage Modification -

This widow finally could afford her payments and bought the time to get back on her feet financially. Her payments were reduced by $432.22 By lowering the interest rate to 3.875%

Interest Rate: 5.75% to 3.875% Mortgage Payment: Lowered by $432.22

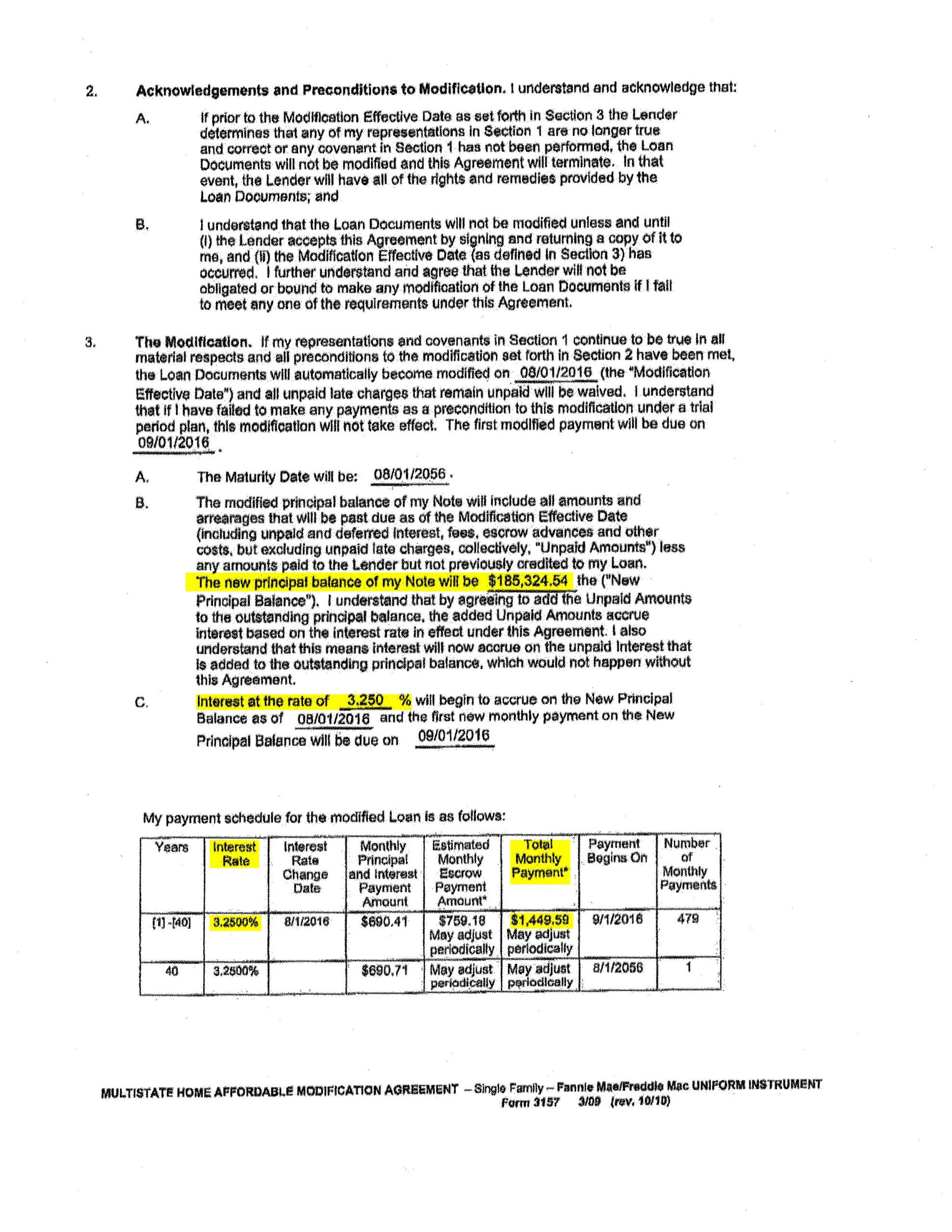

From an Adjustable rate mortgage to 3.25% for life of the loan

-

Approved Modification

Lender: Caliber Home Loans, Inc. -

Home Retention Approved

Single Family Multistate HAMP -

The interest rate adjusted on this couple and was raising to 8.5% making the payments impossible. Lowering the interest rate to 3.25% saved them from foreclosure and lowered their payments by $389.11

Interest Rate: 8.5% to 3.25% Mortgage Payment: Lowered by $389.11 Stopping the foreclosure sale in its tracks.